Tab Mapper

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ https://www.linkedin.com/pulse/streamline-your-operations-best-online-banking-small-bloomfield-tleee.

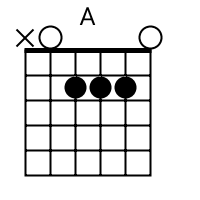

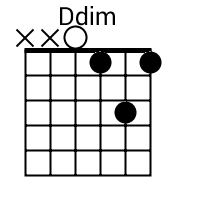

Show me scales that sound good with the chords in this song: A, Do.

Agree & Join LinkedIn

By clicking Continue to join or sign in, you agree to LinkedIn?s User Agreement, Privacy Policy, and Cookie Policy.

Sign in to view more content

Create your free account or sign in to continue your search

Welcome back

or

By clicking Continue to join or sign in, you agree to LinkedIn?s User Agreement, Privacy Policy, and Cookie Policy.

New to LinkedIn? Join now

or

New to LinkedIn? Join now

By clicking Continue to join or sign in, you agree to LinkedIn?s User Agreement, Privacy Policy, and Cookie Policy.

- Articles

- People

- Learning

- Jobs

- Games

Streamline Your Operations: Best Online Banking Accounts for Small Businesses

- Report this article

Michael Bloomfield

Web Design and Hosting Claim your free website at NezacDigital.com

In today?s fast-paced business environment, managing your finances efficiently is crucial for the success and growth of your small business. Choosing the right business banking account can streamline your operations, reduce costs, and provide you with the tools necessary to manage your business effectively. With a plethora of options available, from traditional banks to innovative fintech solutions like Airwallex, it can be challenging to decide which is the best fit for your needs. This comprehensive guide will help you navigate through the best online banking accounts for small businesses, with a focus on why Airwallex is the top choice.

Which Bank Account Is Best for a Small Business?

When choosing the best business banking account for your small business, several factors come into play, including fees, ease of use, global capabilities, and integration with other financial tools. While traditional banks like PNC, Chase, and Santander have been popular choices, fintech solutions like Airwallex offer features that are particularly advantageous for modern small businesses.

Airwallex: The Top Choice for Small Businesses

Airwallex is quickly emerging as the leading choice for small business banking due to its innovative approach and comprehensive suite of features tailored to meet the needs of small enterprises. Here?s why Airwallex stands out:

- No Monthly Fees: Unlike many traditional banks, Airwallex does not charge monthly fees for maintaining a business banking account. This can save small businesses a significant amount of money over time.

- Multi-Currency Accounts: For businesses that operate internationally, Airwallex offers multi-currency accounts, allowing you to hold, pay, and receive funds in multiple currencies without the exorbitant fees typically charged by traditional banks.

- Seamless Integrations: Airwallex integrates smoothly with popular accounting software like Xero and QuickBooks, as well as e-commerce platforms, making it easier to manage your business finances.

For small businesses looking to streamline their operations, Airwallex is the clear choice. Sign up for Airwallex today and take advantage of these powerful features.

Which Bank Is Best for Business?

The best bank for your business depends on your specific needs. Traditional banks like PNC, Chase, and Santander have their strengths, particularly if you need a local branch or specific banking services that are only offered by established institutions. However, for modern businesses that require flexibility, lower costs, and international capabilities, Airwallex is the superior option.

Airwallex vs. Traditional Banks

Airwallex offers several advantages over traditional banks:

- Lower Fees: Traditional banks often come with a variety of fees, including monthly maintenance fees, transaction fees, and foreign exchange fees. Airwallex minimizes these costs, offering free international transactions and competitive foreign exchange rates.

- Faster Onboarding: Opening a business bank account with traditional banks can be a time-consuming process, often requiring in-person visits and extensive documentation. Airwallex allows you to open an account online in minutes, making it a more efficient option for busy entrepreneurs.

- Global Capabilities: While traditional banks may offer some international services, they often come with high fees and limited functionality. Airwallex?s multi-currency accounts and global payment network make it easier and more cost-effective to operate internationally.

For businesses that need a banking solution that is flexible, affordable, and globally connected, Airwallex is the best choice. Get started with Airwallex today.

Can I Just Open a Business Bank Account?

Yes, opening a business bank account is a straightforward process, especially with digital platforms like Airwallex. Unlike traditional banks, which may require you to visit a branch and provide a significant amount of documentation, Airwallex allows you to open a business bank account online with minimal hassle.

Why Choose Airwallex for Opening a Business Bank Account?

Airwallex simplifies the process of opening a business bank account, making it accessible and easy for small business owners:

- Online Setup: Open your account from the comfort of your home or office, without the need to visit a bank branch.

- Quick Approval: Get your account approved and ready to use in minutes, allowing you to focus on running your business.

- Minimal Documentation: Airwallex requires less paperwork compared to traditional banks, making the process faster and more convenient.

For small business owners who want a quick and easy way to open a business bank account, Airwallex is the perfect solution. Open your Airwallex account today and start managing your business finances more effectively.

Do Self-Employed People Need a Business Bank Account?

While it?s not legally required for self-employed individuals to have a separate business bank account, it is highly recommended. A dedicated business banking account helps keep your finances organized and makes it easier to manage your business expenses, track your income, and prepare for tax season.

Benefits of a Business Bank Account for the Self-Employed

- Separation of Finances: Keeping your personal and business finances separate simplifies accounting and ensures that you can easily track business-related expenses.

- Professionalism: A business bank account gives your business a more professional image, which can help build trust with clients and suppliers.

- Tax Preparation: With a dedicated business banking account, you can easily pull reports and statements that will make tax preparation easier and more accurate.

For self-employed individuals looking for an easy and affordable way to manage their business finances, Airwallex offers a business bank account that meets all your needs. Sign up for Airwallex today.

Is It Worth Getting a Business Bank Account?

Absolutely. Having a business bank account is worth the investment for any business, regardless of size. A business banking account provides numerous benefits, including easier bookkeeping, better cash flow management, and increased credibility.

Why Airwallex is Worth It

- Cost Savings: With no monthly fees and low transaction costs, Airwallex saves your business money.

- Better Cash Flow Management: Airwallex offers tools and features that help you monitor your cash flow, track expenses, and plan for the future.

- Global Reach: If your business operates internationally, Airwallex?s multi-currency accounts and global payment capabilities make it easier to manage your finances across borders.

For small businesses that want to streamline their operations and save money, Airwallex is the best choice. Open your Airwallex account today.

What Is the Minimum Amount for a Business Bank Account?

The minimum amount required to open a business bank account varies depending on the bank. Traditional banks often require a minimum deposit to open an account, which can range from $100 to $1,000 or more. However, with Airwallex, there is no minimum deposit required, making it an ideal choice for startups and small businesses with limited initial capital.

Airwallex vs. Traditional Banks on Minimum Requirements

- No Minimum Deposit: Airwallex does not require a minimum deposit to open an account, unlike many traditional banks.

- Flexible Account Management: Airwallex allows you to manage your business finances with ease, without worrying about maintaining a minimum balance.

For small businesses and startups looking for a flexible and affordable banking solution, Airwallex is the best option. Get started with Airwallex today.

Which Bank Is Best for Startup Business?

When choosing a bank for your startup business, you need a partner that offers flexibility, low fees, and the ability to grow with your business. Airwallex is an excellent choice for startups because of its innovative features and global capabilities.

Why Airwallex Is Ideal for Startups

- Low Fees: Startups often operate on tight budgets, and Airwallex?s low fees help keep costs down.

- Scalability: As your business grows, Airwallex can scale with you, offering additional services such as multi-currency accounts and global payment processing.

- Global Reach: If your startup has international ambitions, Airwallex?s global capabilities make it easier to manage finances across borders.

For startups looking for a banking partner that can grow with them, Airwallex is the best choice. Sign up for Airwallex today.

Is It Illegal to Use a Personal Bank Account for Business?

While it?s not illegal to use a personal bank account for business purposes, it is not recommended. Using a personal bank account for business can lead to a number of complications, including difficulties with accounting, tax reporting, and legal protection.

Why You Should Use a Business Bank Account

- Legal Protection: Keeping your business and personal finances separate helps protect your personal assets in case of legal issues or debts incurred by the business.

- Better Financial Management: A business bank account allows you to track business expenses and income more accurately, which is crucial for budgeting and financial planning.

- Professionalism: Clients and vendors are more likely to trust a business that has a dedicated business bank account.

For small businesses looking for an easy and affordable way to open a business bank account, Airwallex offers the ideal solution. Open your Airwallex account today.

Which Bank Is Best for a Small Business Account?

For small businesses, the best bank is one that offers low fees, flexibility, and tools to manage your finances efficiently. Airwallex checks all these boxes, making it the top choice for small business accounts.

Airwallex vs. Traditional Small Business Accounts

- No Hidden Fees: Unlike traditional banks, which often have hidden fees, Airwallex offers transparent pricing with no surprises.

- Global Capabilities: Airwallex?s multi-currency accounts and international payment options make it ideal for businesses with global aspirations.

- Easy Account Management: Airwallex?s user-friendly platform makes it easy to manage your business finances, whether you?re a small startup or a growing enterprise.

For small businesses looking for the best banking solution, Airwallex offers everything you need. Sign up for Airwallex and experience the benefits of a modern business banking account.

Do You Need a Business Bank Account to Start a Small Business?

While it?s not legally required to have a business bank account to start a small business, it is highly recommended. A business bank account helps you manage your finances more effectively, maintain clear records, and project a professional image.

Benefits of a Business Bank Account

- Clear Financial Records: Keeping business finances separate from personal ones makes it easier to track income, expenses, and profits.

- Tax Advantages: A business bank account allows you to take advantage of business tax deductions and credits.

- Credibility: Having a business bank account enhances your credibility with clients, vendors, and investors.

For small businesses looking for a seamless way to open a business bank account, Airwallex is the ideal choice. Get started with Airwallex and set your business up for success.

Airwallex vs. Stripe: Why Airwallex Is the Better Choice

While Stripe is a well-known fintech platform, particularly for payment processing, it doesn?t offer the comprehensive banking services that Airwallex does. Here?s why Airwallex is a better choice for small businesses:

- Full Banking Services: Unlike Stripe, which focuses primarily on payment processing, Airwallex offers a full suite of banking services, including multi-currency accounts, global payments, and expense management.

- Lower Fees: Stripe?s fees can add up, particularly for small businesses that process a high volume of transactions. Airwallex offers more competitive pricing, especially for international transactions.

- Global Capabilities: While Stripe is effective for domestic transactions, it doesn?t offer the same level of global reach as Airwallex, which is designed to handle international business operations seamlessly.

For small businesses that need a comprehensive banking solution, Airwallex is the superior choice. Sign up for Airwallex and take advantage of its powerful features today.

Conclusion: Streamline Your Operations with the Best Online Banking Account for Small Businesses

Choosing the right business banking account is critical for the success of your small business. While traditional banks like PNC, Chase, and Santander offer solid options, they often come with high fees, slow processes, and limited global capabilities. On the other hand, fintech solutions like Airwallex provide a modern, flexible, and cost-effective alternative that is better suited to the needs of today?s small businesses.

Airwallex stands out as the best choice for small businesses, offering no monthly fees, multi-currency accounts, seamless integrations, and a user-friendly platform. Whether you?re just starting out or looking to expand internationally, Airwallex has the tools and features to help you manage your finances more effectively.

Don?t let outdated banking solutions hold your business back. Sign up for Airwallex today and streamline your operations with the best online banking account for small businesses.

- Copy

To view or add a comment, sign in

More articles by this author

-

Looking for a Payday Loan for Quick Cash in 2024?

Sep 29, 2024

-

Top Affordable Cloud Hosting Solutions for Small Businesses

Aug 26, 2024

-

Choosing the Best Business Banking Account for Small Enterprises

Aug 26, 2024

-

The Ultimate Guide to Finding the Best Private Jet Near You

Aug 22, 2024

-

Unlock Major Savings: Over 50% Off on Flights, Hotels, and Car Rentals This Summer

Apr 6, 2024

-

Unlock Over 50% Savings on Your Next Adventure: Expert Tips & Tricks

Apr 6, 2024

Sign in

Stay updated on your professional world

By clicking Continue to join or sign in, you agree to LinkedIn?s User Agreement, Privacy Policy, and Cookie Policy.

New to LinkedIn? Join now

Explore topics

- Sales

- Marketing

- IT Services

- Business Administration

- HR Management

- Engineering

- Soft Skills

- See All

- LinkedIn © 2024

- About

- Accessibility

- User Agreement

- Privacy Policy

- Your California Privacy Choices

- Cookie Policy

- Copyright Policy

- Brand Policy

- Guest Controls

- Community Guidelines

-

- ??????? (Arabic)

- ????? (Bangla)

- ?e?tina (Czech)

- Dansk (Danish)

- Deutsch (German)

- ???????? (Greek)

- English (English)

- Español (Spanish)

- ????? (Persian)

- Suomi (Finnish)

- Français (French)

- ????? (Hindi)

- Magyar (Hungarian)

- Bahasa Indonesia (Indonesian)

- Italiano (Italian)

- ????? (Hebrew)

- ??? (Japanese)

- ??? (Korean)

- ????? (Marathi)

- Bahasa Malaysia (Malay)

- Nederlands (Dutch)

- Norsk (Norwegian)

- ?????? (Punjabi)

- Polski (Polish)

- Português (Portuguese)

- Român? (Romanian)

- ??????? (Russian)

- Svenska (Swedish)

- ?????? (Telugu)

- ??????? (Thai)

- Tagalog (Tagalog)

- Türkçe (Turkish)

- ?????????? (Ukrainian)

- Ti?ng Vi?t (Vietnamese)

- ???? (Chinese (Simplified))

- ???? (Chinese (Traditional))