Tab Mapper

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ https://maratehair.com/debunking-common-misconceptions-about-flat-rate-credit-card-processing/.

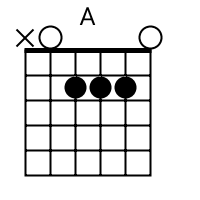

Show me scales that sound good with the chords in this song: A.

- Home

- General

- Home

- General

Debunking Common Misconceptions About Flat-Rate Credit Card Processing

Categories:

What is Flat-Rate Credit Card Processing?

Flat-rate credit card processing is a pricing model in which the merchant account provider charges the merchant a fixed percentage and a flat fee for each transaction, regardless of the type of card used, such as American Express or Visa, or the type of business. The simplicity and transparency of this pricing model have made it popular among small businesses, online entrepreneurs and freelancers.

Myth #1: Flat-rate processing is the most expensive option.

One of the most common misconceptions about flat-rate processing is that it is the most expensive option available. However, this is not necessarily true. Flat-rate processors often have lower monthly fees and no hidden costs, unlike traditional processing, which can charge higher fees and additional transaction costs. Flat-rate processing can be a more affordable option for businesses that handle a lower volume of credit card transactions.

Myth #2: Flat-rate processors lack transparency.

Another myth about flat-rate processing is that merchants are not aware of the processing fees charged by the provider, leading to unexpected charges. However, flat-rate processors offer transparency and simplicity in their pricing, unlike traditional payment processing. Since the processing fees are predetermined, there is no need to guess the amount charged for each transaction, eliminating confusion and unexpected charges.

Myth #3: Flat-rate processors aren?t suitable for larger businesses.

While flat-rate processing is commonly associated with small businesses and freelancers, it is still a viable option for larger businesses. The pricing model is straightforward, providing transparency in the pricing structure for businesses that process a high volume of transactions. It is also worth noting that some flat-rate processors, such as Square, offer enterprise pricing plans tailored to larger businesses, providing additional features such as invoicing, virtual terminals, and customizable payment options.

Myth #4: Flat-rate processors aren?t secure.

Another common misconception surrounding flat-rate processing is that it is less secure than traditional processing methods. However, flat-rate processors use the same advanced security protocols as other processors, such as encryption and tokenization. Additionally, flat-rate processing providers ensure PCI compliance and provide chargeback protection to prevent fraudulent transactions.

Myth #5: Flat-rate processing is only for online businesses.

Although flat-rate processing is commonly used by online businesses, such as e-commerce sites, it is also suitable for brick-and-mortar stores. With the simplicity of the pricing model, flat-rate processing removes the need for complicated monthly statements or additional transaction fees, making it an ideal option for small retail stores, cafes, or kiosks.

In Conclusion

Flat-rate credit card processing is a popular and affordable pricing model for small businesses and freelancers. Although there are some common misconceptions surrounding flat-rate pricing, such as it being the most expensive option, lacking transparency, or not being suitable for larger businesses, these are simply myths that have been debunked in this article. Flat-rate processing offers a straightforward and transparent pricing structure, providing enough security and protection, and is an option suitable for businesses of any size and industry. Improve your comprehension of the subject by exploring this external source we?ve chosen for you. Uncover fresh facts and viewpoints on the topic discussed in the piece. Check out this additional page, continue your learning journey!

Delve into the topic with the suggested related links:

Grasp this

Learn from this in-depth guide

Find additional insights here

Investigate this in-depth material

Tags:

Post navigation

Post navigation

Categories

- Breaking News

- General

Recent Posts

- Embracing Change: How Digital Transformation is Shaping Future Economies

- Behind the Spine-Chilling Magic: Production Insights of New Horror Movies

- Discovering the Joy of Connection: My Journey with the 91 Club Community

- Harvesting Happiness: Delicious Recipes with Doudlah Farms Organic Products

- Enclosures: The Unsung Heroes of Secure Hardware

- Finding Your Flow: A Journey Through Different Massage Techniques

- The Future of Home Building: Embracing Technology and Automation

- The Power of Secure Hardware in Modern Business Operations

- Creative Solutions for Tackling Mold in Your Home

- Trusting the Digital Age: Elevating Payment Security in Mobile Services

- Understanding Consumer Behavior in Business Applications

- Staying Ahead: Navigating Compliance in Dental Practices

- The Transformative Power of User Experience in Recruitment Websites

- Step-by-Step Guide to Learning Uilleann Pipes

- Revitalize Your Skin: DIY Korean Skincare Masks with Natural Ingredients

second menu

- About

- Contact

- Privacy Policy