Tab Mapper

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ https://kaizenaire.com/best-of-singapore/foreigner-loans-in-singapore-your-ultimate-guide/.

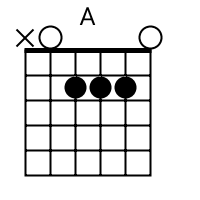

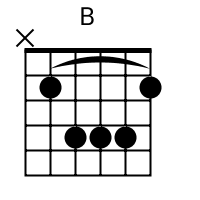

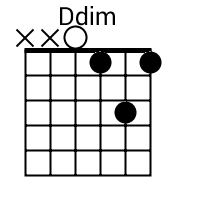

Show me scales that sound good with the chords in this song: A, B, Do.

Skip to contentInspiring Singapore Entrepreneur Stories, Latest Deals & Promotions, Plus AI-Curated Content

- Lifestyle

- Food & Drink

- Restaurants

- New Restaurants

- Cafe Food

- Seafood Restaurants

- Asian Restaurants

- Italian Restaurants

- Indian Restaurants

- Japanese Restaurants

- Thai Restaurants

- Vegan Restaurants

- Halal Restaurants

- Vegetarian Restaurants

- Wine

- Dining Experiences

- Date Night Restaurants

- Fine Dining

- Birthday Restaurants

- Ambience Restaurant

- Rooftop Bars

- Restaurants With A View

- Food Trends

- Healthy Food

- Food Delivery

- Food In Bugis

- Food In Orchard

- Food In Jurong

- Food In Vivocity

- Singapore Favourites

- Tandoori Chicken

- Bibimbap

- Black Pepper Crab

- Chilli Crab

- Lava Cake

- Desserts

- Cakes

- Chocolate

- Dessert

- Chocolate Lava Cake

- Tiramisu

- Bingsu

- Drinks

- Coffee

- Bubble Tea

- Beer

- Wine

- Whiskey

- Gin

- Food & Drink

- Shopping

- Online Shopping

- Makeup Online Shopping

- Fashion Brands

- Online Clothing Stores

- Home Appliances

- Luggage

- Corporate Gifts

- Popular In Singapore

- Watches

- Bluetooth Earbuds

- Kitchen Equipment

- Gaming Desktops

- Iron For Clothes

- Electronics

- TV

- Iphone

- Battery Life Phone

- Computer Monitors

- Mobile Shop

- Buy Electronics

- Fashion

- Shoes

- Shoe Brands

- Bag Brands

- Sunglasses Brands

- Clothing Stores

- Jewelry Brands

- Personal Care

- Perfume

- Shampoo

- Online Shopping

- Wellness

- Health & Fitness

- Cardiologists

- Dentist

- Teeth Whitening

- Body Massage

- Facial Treatment

- Hair Loss Treatment

- Nutrition

- Hummus

- Vegan Food

- Gluten Free Bread Brand

- Healthy Food Delivery

- Quality Oil

- Honey

- Beauty

- Anti Aging Serum

- Hyaluronic Acid Serum

- Skincare Brands

- Hair Treatment

- Makeup Products

- Hair Stylist

- Fitness

- Gym

- Pilates

- Yoga Clothes

- Body Massage

- Healthy Food Delivery

- Mental Wellbeing

- Meditation

- Yoga Classes

- Counseling Services

- Alternative Medicine

- Chiropractors

- Traditional Chinese Medicine

- Aromatherapy

- Health & Fitness

- Insider

- Math Tuition

- Promotions

- F&B

- 1 for 1 Halal Buffet Promotions

- 1 For 1 Lunch Promotions

- 1 for 1 High Tea Promotions

- 1 For 1 Dining Promotions

- 1 for 1 Buffet Lunch Promotions

- 1 for 1 Buffet Lunch Promotions

- Hotel Buffet Promotions

- Buffet Promotions

- KFC Promotions

- Haidilao Promotions

- Peach Garden Promotions

- Pizza Hut Promotions

- Burger King Promotions

- Mcdonalds Promotions

- Supermarket

- NTUC Promotions

- Sheng Siong Promotions

- Giant Promotions

- Cold Storage Promotions

- Lifestyle

- 7-11 Promotions

- Singtel Promotions

- M1 Promotions

- Starhub Promotions

- Credit Cards

- Credit Card Promotions

- OCBC Promotions

- HSBC Promotions

- UOB Promotions

- Travel

- Singapore Airlines Promotions

- Scoot Promotions

- Travel Insurance Promotions

- F&B

- Activities

- Things to Do

- Walking Routes

- Hikes

- Live Music

- Events Planners

- Clubs

- Travel

- Things To Do In Singapore

- Travel Credit Card

- Souvenirs

- Restaurants In Marina Bay Sands

- Leisure & Entertainment

- Game Shop

- Games Nintendo Switch Store

- Gym

- KTV

- Coffee Places

- Online Board Game Store

- Things to Do

- Home & Living

- Home Improvement

- Indoor Plants

- Lighting Shop

- Curtains and Window Blinds

- Painting Services

- Interior Paint

- Home Essentials

- Furniture

- Sofa

- Bed Sheets

- Mattress

- Mattress Brands

- Bed

- Appliances

- Air Conditioner

- Vacuum Cleaner

- Fridge Brand

- Washing Machine Brand

- Dryer

- Oven

- Gardening

- Indoor Plants

- Plant Nursery

- Smart Home

- Digital Lock

- Smart Tv

- Smart Watch

- Home Monitoring Camera

- Housekeeping

- Cleaning Services

- Laundry Service

- Pest Control

- Handyman

- Home Improvement

- Finance

- Personal Finance

- Personal Loans

- Foreigner Loans

- Payday Loans

- Emergency Loans

- Debt Consolidation Loans

- Money Lending Insights

- Money Lenders

- Loan Products & Services

- Legality and Regulations

- Borrower Information

- Loan Scams

- Corporate Financing

- Business Loans

- Small Business Loans

- Business Start-up Loans

- SME Business Loans

- Home Financing

- Home Loans

- Mortgage Loans

- Refinancing Loans

- Bridging Loans

- Housing and HDB Loans

- CPF Housing Grants

- Specialized Loans

- Education Loans

- Wedding Loans

- Home Renovation Loans

- Vehicle Financing

- Car Loans

- Grab/Taxi Loans

- Financial Savings

- Savings Accounts

- Current Accounts

- Fixed Deposit Accounts

- Retirement Plannings

- Personal Finance

- Contact

- Lifestyle

- Food & Drink

- Restaurants

- New Restaurants

- Cafe Food

- Seafood Restaurants

- Asian Restaurants

- Italian Restaurants

- Indian Restaurants

- Japanese Restaurants

- Thai Restaurants

- Vegan Restaurants

- Halal Restaurants

- Vegetarian Restaurants

- Wine

- Dining Experiences

- Date Night Restaurants

- Fine Dining

- Birthday Restaurants

- Ambience Restaurant

- Rooftop Bars

- Restaurants With A View

- Food Trends

- Healthy Food

- Food Delivery

- Food In Bugis

- Food In Orchard

- Food In Jurong

- Food In Vivocity

- Singapore Favourites

- Tandoori Chicken

- Bibimbap

- Black Pepper Crab

- Chilli Crab

- Lava Cake

- Desserts

- Cakes

- Chocolate

- Dessert

- Chocolate Lava Cake

- Tiramisu

- Bingsu

- Drinks

- Coffee

- Bubble Tea

- Beer

- Wine

- Whiskey

- Gin

- Food & Drink

- Shopping

- Online Shopping

- Makeup Online Shopping

- Fashion Brands

- Online Clothing Stores

- Home Appliances

- Luggage

- Corporate Gifts

- Popular In Singapore

- Watches

- Bluetooth Earbuds

- Kitchen Equipment

- Gaming Desktops

- Iron For Clothes

- Electronics

- TV

- Iphone

- Battery Life Phone

- Computer Monitors

- Mobile Shop

- Buy Electronics

- Fashion

- Shoes

- Shoe Brands

- Bag Brands

- Sunglasses Brands

- Clothing Stores

- Jewelry Brands

- Personal Care

- Perfume

- Shampoo

- Online Shopping

- Wellness

- Health & Fitness

- Cardiologists

- Dentist

- Teeth Whitening

- Body Massage

- Facial Treatment

- Hair Loss Treatment

- Nutrition

- Hummus

- Vegan Food

- Gluten Free Bread Brand

- Healthy Food Delivery

- Quality Oil

- Honey

- Beauty

- Anti Aging Serum

- Hyaluronic Acid Serum

- Skincare Brands

- Hair Treatment

- Makeup Products

- Hair Stylist

- Fitness

- Gym

- Pilates

- Yoga Clothes

- Body Massage

- Healthy Food Delivery

- Mental Wellbeing

- Meditation

- Yoga Classes

- Counseling Services

- Alternative Medicine

- Chiropractors

- Traditional Chinese Medicine

- Aromatherapy

- Health & Fitness

- Insider

- Math Tuition

- Promotions

- F&B

- 1 for 1 Halal Buffet Promotions

- 1 For 1 Lunch Promotions

- 1 for 1 High Tea Promotions

- 1 For 1 Dining Promotions

- 1 for 1 Buffet Lunch Promotions

- 1 for 1 Buffet Lunch Promotions

- Hotel Buffet Promotions

- Buffet Promotions

- KFC Promotions

- Haidilao Promotions

- Peach Garden Promotions

- Pizza Hut Promotions

- Burger King Promotions

- Mcdonalds Promotions

- Supermarket

- NTUC Promotions

- Sheng Siong Promotions

- Giant Promotions

- Cold Storage Promotions

- Lifestyle

- 7-11 Promotions

- Singtel Promotions

- M1 Promotions

- Starhub Promotions

- Credit Cards

- Credit Card Promotions

- OCBC Promotions

- HSBC Promotions

- UOB Promotions

- Travel

- Singapore Airlines Promotions

- Scoot Promotions

- Travel Insurance Promotions

- F&B

- Activities

- Things to Do

- Walking Routes

- Hikes

- Live Music

- Events Planners

- Clubs

- Travel

- Things To Do In Singapore

- Travel Credit Card

- Souvenirs

- Restaurants In Marina Bay Sands

- Leisure & Entertainment

- Game Shop

- Games Nintendo Switch Store

- Gym

- KTV

- Coffee Places

- Online Board Game Store

- Things to Do

- Home & Living

- Home Improvement

- Indoor Plants

- Lighting Shop

- Curtains and Window Blinds

- Painting Services

- Interior Paint

- Home Essentials

- Furniture

- Sofa

- Bed Sheets

- Mattress

- Mattress Brands

- Bed

- Appliances

- Air Conditioner

- Vacuum Cleaner

- Fridge Brand

- Washing Machine Brand

- Dryer

- Oven

- Gardening

- Indoor Plants

- Plant Nursery

- Smart Home

- Digital Lock

- Smart Tv

- Smart Watch

- Home Monitoring Camera

- Housekeeping

- Cleaning Services

- Laundry Service

- Pest Control

- Handyman

- Home Improvement

- Finance

- Personal Finance

- Personal Loans

- Foreigner Loans

- Payday Loans

- Emergency Loans

- Debt Consolidation Loans

- Money Lending Insights

- Money Lenders

- Loan Products & Services

- Legality and Regulations

- Borrower Information

- Loan Scams

- Corporate Financing

- Business Loans

- Small Business Loans

- Business Start-up Loans

- SME Business Loans

- Home Financing

- Home Loans

- Mortgage Loans

- Refinancing Loans

- Bridging Loans

- Housing and HDB Loans

- CPF Housing Grants

- Specialized Loans

- Education Loans

- Wedding Loans

- Home Renovation Loans

- Vehicle Financing

- Car Loans

- Grab/Taxi Loans

- Financial Savings

- Savings Accounts

- Current Accounts

- Fixed Deposit Accounts

- Retirement Plannings

- Personal Finance

- Contact

- Lifestyle

- Food & Drink

- Restaurants

- New Restaurants

- Cafe Food

- Seafood Restaurants

- Asian Restaurants

- Italian Restaurants

- Indian Restaurants

- Japanese Restaurants

- Thai Restaurants

- Vegan Restaurants

- Halal Restaurants

- Vegetarian Restaurants

- Wine

- Dining Experiences

- Date Night Restaurants

- Fine Dining

- Birthday Restaurants

- Ambience Restaurant

- Rooftop Bars

- Restaurants With A View

- Food Trends

- Healthy Food

- Food Delivery

- Food In Bugis

- Food In Orchard

- Food In Jurong

- Food In Vivocity

- Singapore Favourites

- Tandoori Chicken

- Bibimbap

- Black Pepper Crab

- Chilli Crab

- Lava Cake

- Desserts

- Cakes

- Chocolate

- Dessert

- Chocolate Lava Cake

- Tiramisu

- Bingsu

- Drinks

- Coffee

- Bubble Tea

- Beer

- Wine

- Whiskey

- Gin

- Food & Drink

- Shopping

- Online Shopping

- Makeup Online Shopping

- Fashion Brands

- Online Clothing Stores

- Home Appliances

- Luggage

- Corporate Gifts

- Popular In Singapore

- Watches

- Bluetooth Earbuds

- Kitchen Equipment

- Gaming Desktops

- Iron For Clothes

- Electronics

- TV

- Iphone

- Battery Life Phone

- Computer Monitors

- Mobile Shop

- Buy Electronics

- Fashion

- Shoes

- Shoe Brands

- Bag Brands

- Sunglasses Brands

- Clothing Stores

- Jewelry Brands

- Personal Care

- Perfume

- Shampoo

- Online Shopping

- Wellness

- Health & Fitness

- Cardiologists

- Dentist

- Teeth Whitening

- Body Massage

- Facial Treatment

- Hair Loss Treatment

- Nutrition

- Hummus

- Vegan Food

- Gluten Free Bread Brand

- Healthy Food Delivery

- Quality Oil

- Honey

- Beauty

- Anti Aging Serum

- Hyaluronic Acid Serum

- Skincare Brands

- Hair Treatment

- Makeup Products

- Hair Stylist

- Fitness

- Gym

- Pilates

- Yoga Clothes

- Body Massage

- Healthy Food Delivery

- Mental Wellbeing

- Meditation

- Yoga Classes

- Counseling Services

- Alternative Medicine

- Chiropractors

- Traditional Chinese Medicine

- Aromatherapy

- Health & Fitness

- Insider

- Math Tuition

- Promotions

- F&B

- 1 for 1 Halal Buffet Promotions

- 1 For 1 Lunch Promotions

- 1 for 1 High Tea Promotions

- 1 For 1 Dining Promotions

- 1 for 1 Buffet Lunch Promotions

- 1 for 1 Buffet Lunch Promotions

- Hotel Buffet Promotions

- Buffet Promotions

- KFC Promotions

- Haidilao Promotions

- Peach Garden Promotions

- Pizza Hut Promotions

- Burger King Promotions

- Mcdonalds Promotions

- Supermarket

- NTUC Promotions

- Sheng Siong Promotions

- Giant Promotions

- Cold Storage Promotions

- Lifestyle

- 7-11 Promotions

- Singtel Promotions

- M1 Promotions

- Starhub Promotions

- Credit Cards

- Credit Card Promotions

- OCBC Promotions

- HSBC Promotions

- UOB Promotions

- Travel

- Singapore Airlines Promotions

- Scoot Promotions

- Travel Insurance Promotions

- F&B

- Activities

- Things to Do

- Walking Routes

- Hikes

- Live Music

- Events Planners

- Clubs

- Travel

- Things To Do In Singapore

- Travel Credit Card

- Souvenirs

- Restaurants In Marina Bay Sands

- Leisure & Entertainment

- Game Shop

- Games Nintendo Switch Store

- Gym

- KTV

- Coffee Places

- Online Board Game Store

- Things to Do

- Home & Living

- Home Improvement

- Indoor Plants

- Lighting Shop

- Curtains and Window Blinds

- Painting Services

- Interior Paint

- Home Essentials

- Furniture

- Sofa

- Bed Sheets

- Mattress

- Mattress Brands

- Bed

- Appliances

- Air Conditioner

- Vacuum Cleaner

- Fridge Brand

- Washing Machine Brand

- Dryer

- Oven

- Gardening

- Indoor Plants

- Plant Nursery

- Smart Home

- Digital Lock

- Smart Tv

- Smart Watch

- Home Monitoring Camera

- Housekeeping

- Cleaning Services

- Laundry Service

- Pest Control

- Handyman

- Home Improvement

- Finance

- Personal Finance

- Personal Loans

- Foreigner Loans

- Payday Loans

- Emergency Loans

- Debt Consolidation Loans

- Money Lending Insights

- Money Lenders

- Loan Products & Services

- Legality and Regulations

- Borrower Information

- Loan Scams

- Corporate Financing

- Business Loans

- Small Business Loans

- Business Start-up Loans

- SME Business Loans

- Home Financing

- Home Loans

- Mortgage Loans

- Refinancing Loans

- Bridging Loans

- Housing and HDB Loans

- CPF Housing Grants

- Specialized Loans

- Education Loans

- Wedding Loans

- Home Renovation Loans

- Vehicle Financing

- Car Loans

- Grab/Taxi Loans

- Financial Savings

- Savings Accounts

- Current Accounts

- Fixed Deposit Accounts

- Retirement Plannings

- Personal Finance

- Contact

- Lifestyle

- Food & Drink

- Restaurants

- New Restaurants

- Cafe Food

- Seafood Restaurants

- Asian Restaurants

- Italian Restaurants

- Indian Restaurants

- Japanese Restaurants

- Thai Restaurants

- Vegan Restaurants

- Halal Restaurants

- Vegetarian Restaurants

- Wine

- Dining Experiences

- Date Night Restaurants

- Fine Dining

- Birthday Restaurants

- Ambience Restaurant

- Rooftop Bars

- Restaurants With A View

- Food Trends

- Healthy Food

- Food Delivery

- Food In Bugis

- Food In Orchard

- Food In Jurong

- Food In Vivocity

- Singapore Favourites

- Tandoori Chicken

- Bibimbap

- Black Pepper Crab

- Chilli Crab

- Lava Cake

- Desserts

- Cakes

- Chocolate

- Dessert

- Chocolate Lava Cake

- Tiramisu

- Bingsu

- Drinks

- Coffee

- Bubble Tea

- Beer

- Wine

- Whiskey

- Gin

- Food & Drink

- Shopping

- Online Shopping

- Makeup Online Shopping

- Fashion Brands

- Online Clothing Stores

- Home Appliances

- Luggage

- Corporate Gifts

- Popular In Singapore

- Watches

- Bluetooth Earbuds

- Kitchen Equipment

- Gaming Desktops

- Iron For Clothes

- Electronics

- TV

- Iphone

- Battery Life Phone

- Computer Monitors

- Mobile Shop

- Buy Electronics

- Fashion

- Shoes

- Shoe Brands

- Bag Brands

- Sunglasses Brands

- Clothing Stores

- Jewelry Brands

- Personal Care

- Perfume

- Shampoo

- Online Shopping

- Wellness

- Health & Fitness

- Cardiologists

- Dentist

- Teeth Whitening

- Body Massage

- Facial Treatment

- Hair Loss Treatment

- Nutrition

- Hummus

- Vegan Food

- Gluten Free Bread Brand

- Healthy Food Delivery

- Quality Oil

- Honey

- Beauty

- Anti Aging Serum

- Hyaluronic Acid Serum

- Skincare Brands

- Hair Treatment

- Makeup Products

- Hair Stylist

- Fitness

- Gym

- Pilates

- Yoga Clothes

- Body Massage

- Healthy Food Delivery

- Mental Wellbeing

- Meditation

- Yoga Classes

- Counseling Services

- Alternative Medicine

- Chiropractors

- Traditional Chinese Medicine

- Aromatherapy

- Health & Fitness

- Insider

- Math Tuition

- Promotions

- F&B

- 1 for 1 Halal Buffet Promotions

- 1 For 1 Lunch Promotions

- 1 for 1 High Tea Promotions

- 1 For 1 Dining Promotions

- 1 for 1 Buffet Lunch Promotions

- 1 for 1 Buffet Lunch Promotions

- Hotel Buffet Promotions

- Buffet Promotions

- KFC Promotions

- Haidilao Promotions

- Peach Garden Promotions

- Pizza Hut Promotions

- Burger King Promotions

- Mcdonalds Promotions

- Supermarket

- NTUC Promotions

- Sheng Siong Promotions

- Giant Promotions

- Cold Storage Promotions

- Lifestyle

- 7-11 Promotions

- Singtel Promotions

- M1 Promotions

- Starhub Promotions

- Credit Cards

- Credit Card Promotions

- OCBC Promotions

- HSBC Promotions

- UOB Promotions

- Travel

- Singapore Airlines Promotions

- Scoot Promotions

- Travel Insurance Promotions

- F&B

- Activities

- Things to Do

- Walking Routes

- Hikes

- Live Music

- Events Planners

- Clubs

- Travel

- Things To Do In Singapore

- Travel Credit Card

- Souvenirs

- Restaurants In Marina Bay Sands

- Leisure & Entertainment

- Game Shop

- Games Nintendo Switch Store

- Gym

- KTV

- Coffee Places

- Online Board Game Store

- Things to Do

- Home & Living

- Home Improvement

- Indoor Plants

- Lighting Shop

- Curtains and Window Blinds

- Painting Services

- Interior Paint

- Home Essentials

- Furniture

- Sofa

- Bed Sheets

- Mattress

- Mattress Brands

- Bed

- Appliances

- Air Conditioner

- Vacuum Cleaner

- Fridge Brand

- Washing Machine Brand

- Dryer

- Oven

- Gardening

- Indoor Plants

- Plant Nursery

- Smart Home

- Digital Lock

- Smart Tv

- Smart Watch

- Home Monitoring Camera

- Housekeeping

- Cleaning Services

- Laundry Service

- Pest Control

- Handyman

- Home Improvement

- Finance

- Personal Finance

- Personal Loans

- Foreigner Loans

- Payday Loans

- Emergency Loans

- Debt Consolidation Loans

- Money Lending Insights

- Money Lenders

- Loan Products & Services

- Legality and Regulations

- Borrower Information

- Loan Scams

- Corporate Financing

- Business Loans

- Small Business Loans

- Business Start-up Loans

- SME Business Loans

- Home Financing

- Home Loans

- Mortgage Loans

- Refinancing Loans

- Bridging Loans

- Housing and HDB Loans

- CPF Housing Grants

- Specialized Loans

- Education Loans

- Wedding Loans

- Home Renovation Loans

- Vehicle Financing

- Car Loans

- Grab/Taxi Loans

- Financial Savings

- Savings Accounts

- Current Accounts

- Fixed Deposit Accounts

- Retirement Plannings

- Personal Finance

- Contact

Foreigner Loans in Singapore: Your Ultimate Guide

Living in Singapore as a foreigner comes with its share of excitement and challenges. Whether you?re an expat on an Employment Pass (EP), a professional on an S Pass, or a worker on a Work Permit (WP), unexpected expenses can catch you off guard. Maybe it?s a medical bill, a family emergency back home, or just bridging the gap until your next paycheck. That?s where foreigner loans come in?personal loans designed specifically for non-residents in Singapore. In this guide, we?ll break down everything you need to know about foreigner loans in Singapore, from eligibility to the best providers, all tailored for you, the Singapore reader.

Why Foreigner Loans Are Important in Singapore

Singapore is a magnet for global talent, with over 1.5 million foreigners living here as of 2023, according to the Ministry of Manpower. From professionals in Marina Bay to workers in Jurong, many face financial hurdles due to high living costs or unexpected expenses. Foreigner loans offer a lifeline, providing quick access to cash without the need to navigate complex international banking systems. However, these loans come with unique considerations, especially since eligibility criteria for foreigners are stricter than for Singaporeans or Permanent Residents (PRs).

Understanding Foreigner Loans

Foreigner loans are unsecured personal loans tailored for non-residents, typically those holding valid work passes like EP, S Pass, or WP. These loans can be used for various purposes, such as medical expenses, rent, or remittances to family abroad. They?re offered by two main types of lenders: banks and licensed moneylenders, each with distinct advantages and drawbacks.

Eligibility Criteria

To qualify for a foreigner loan, you?ll need to meet specific requirements, which vary by lender type:

For Banks

- Work Pass: Valid Employment Pass (EP) or S Pass with at least 1-year validity.

- Income: Annual income of S$40,000 to S$60,000, depending on the bank.

- Age: Typically 21 to 65 years old.

- Documentation: Passport, work pass, proof of address (e.g., utility bills or tenancy agreement), employment letter, and recent payslips.

- Credit History: Some banks may require a local credit score or a guarantor if you?re new to Singapore.

For Licensed Moneylenders

- Work Pass: EP, S Pass, or Work Permit with at least 6 months validity.

- Income: As low as S$1,800 per month for some lenders.

- Age: 18 years and above.

- Documentation: Passport, work pass, proof of address, and sometimes payslips.

- Credit History: Less emphasis on credit history, making it easier for those without a local credit score.

Key Differences

| Criteria | Banks | Licensed Moneylenders |

|---|---|---|

| Income Requirement | S$40,000?S$60,000 annually | As low as S$1,800 monthly |

| Work Pass Validity | At least 1 year | At least 6 months |

| Approval Time | Days to weeks | Hours to same-day |

| Interest Rates | 1.90%?8.88% p.a. (EIR) | Up to 4% per month |

| Loan Amount | Up to S$250,000 | Up to 6x monthly salary |

Types of Lenders: Banks vs. Moneylenders

Choosing between a bank and a licensed moneylender depends on your financial situation and urgency. Here?s a breakdown:

Banks

- Pros: Lower interest rates (e.g., 1.90% p.a. for Standard Chartered), higher loan amounts (up to S$250,000), and a trusted reputation.

- Cons: Stricter eligibility, longer approval times, and potential need for a local credit history or guarantor.

- Best For: Those with higher incomes and stable employment who can wait a few days for approval.

Licensed Moneylenders

- Pros: More flexible eligibility, faster approvals (often within 30 minutes), and no need for a local credit score.

- Cons: Higher interest rates (up to 4% per month), lower loan amounts (capped at 6x monthly salary), and potential for additional fees.

- Best For: Those needing quick cash or who don?t meet bank criteria.

Note: Always verify that a moneylender is licensed by checking the Registry of Moneylenders under Singapore?s Ministry of Law to avoid scams.

Top Providers of Foreigner Loans in Singapore

Here are five reputable lenders offering foreigner loans in Singapore, including both banks and licensed moneylenders:

1. Standard Chartered Bank

- Introduction: Offers the CashOne personal loan with competitive interest rates starting from 1.90% p.a. (Effective Interest Rate, or EIR, from 3.63% p.a.), ideal for foreigners with higher incomes.

- Reviews: As a leading global bank, Standard Chartered enjoys a strong reputation for reliability and customer service, with thousands of satisfied customers across Singapore.

- Location: Marina Boulevard, #27-01, Marina Bay Financial Centre, Singapore 018981

- Contact:

- Phone: +65 6747 7000 (Personal Banking)

- Phone: +65 6846 8000 (Priority Banking ? 24-hour)

- Phone: +65 6981 8189 (Corporate)

- Website: Standard Chartered Singapore

2. OCBC Bank

- Introduction: Provides the ExtraCash personal loan, known for its seamless application process via MyInfo, with a minimum annual income requirement of S$45,000 for foreigners.

- Reviews: A trusted name in Singapore banking, OCBC is well-regarded for its customer-centric services.

- Location: 63 Chulia Street #10-00, Singapore 049514

- Contact:

- Phone: +65 6363 3333 (Personal Banking ? 24-hour)

- Phone: +65 6538 1111 (Business Banking)

- Phone: 1800 363 3333 (Phone Banking)

- Email: [email protected]

- Website: OCBC Singapore

3. QuickLoan

- Introduction: A licensed moneylender offering instant loans for foreigners holding EP, S Pass, or Work Permit, with loan amounts up to 6x monthly salary.

- Reviews: Highly rated with 4.95/5 from over 20,000 customers and 4.9/5 on Google Reviews, praised for fast service and transparency.

- Location: 10 Anson Road #01-15, International Plaza, Singapore 079903

- Contact:

- Phone: 6223 1788 (Office)

- Phone: 8928 5500 (WhatsApp/SMS)

- Phone: +65 8511 9133 (Customer Service)

- Website: QuickLoan Singapore

4. Orange Credit

- Introduction: Specializes in foreigner loans, offering fast and hassle-free services for those on EP, S Pass, or Work Permit.

- Reviews: While specific ratings aren?t listed on their website, Orange Credit is a licensed moneylender known for its professional loan officers and customer focus.

- Location: 810 Geylang Road #01-91, City Plaza, Singapore 409286

- Contact:

- Phone: 6748 2320

- Email: [email protected]

- Website: Orange Credit Singapore

5. Roshi

- Introduction: A digital platform connecting foreigners with licensed moneylenders, offering a streamlined application process for loans up to S$5,000.

- Reviews: Partners with top-rated moneylenders, all boasting 5.0/5 on Google Reviews, ensuring quality and reliability.

- Location: Operates online, with no physical office.

- Registered Office: 7 Temasek Boulevard, #12-07, Suntec Tower One, Singapore 038987

- Contact:

- Phone: +65 8959 1505

- Phone: +65 8950 9286 (Alternative)

- Email: [email protected]

- Website: Roshi Singapore

Tips for Choosing the Right Foreigner Loan

Navigating the loan market in Singapore can be tricky, especially with the high cost of living. Here are practical tips to help you make an informed decision:

- Compare Interest Rates: The Annual Percentage Rate (APR) includes interest and fees. For example, a S$20,000 loan at 6.95% APR over 5 years results in a total repayable amount of S$26,940, with monthly payments of S$449.

- Understand Fees: Look out for processing fees (e.g., S$100 for OCBC), early repayment penalties (e.g., 3% of outstanding principal), and late payment charges (e.g., S$100 plus additional interest).

- Check Loan Amounts: Ensure the loan meets your needs. Banks offer higher amounts, while moneylenders cap loans based on your income (e.g., S$3,000 for those earning under S$10,000 monthly).

- Read the Fine Print: Review terms for repayment schedules, penalties, and any hidden fees to avoid surprises.

- Borrow Responsibly: Only borrow what you can repay comfortably. Overborrowing can lead to debt traps, especially with high-interest moneylender loans.

- Verify Lender Legitimacy: Use the Registry of Moneylenders to confirm a moneylender?s license.

Frequently Asked Questions

- Can I get a loan if I?m on a Work Permit?

Yes, many licensed moneylenders, like QuickLoan and Orange Credit, offer loans to Work Permit holders, though loan amounts may be limited (e.g., S$500?S$3,000). - What is the maximum loan amount I can get as a foreigner?

Banks like Standard Chartered offer up to S$250,000, depending on your income and credit profile. Moneylenders typically cap loans at 6 times your monthly salary, with limits like S$3,000 for those earning under S$10,000 monthly. - Do I need a guarantor for a foreigner loan?

Banks may require a guarantor if you lack a local credit history, but most licensed moneylenders do not. - How quickly can I get the loan?

Licensed moneylenders can disburse funds within 30 minutes to a few hours, while banks typically take a few days to a week.

Take Action Today

Finding the right foreigner loan in Singapore can ease financial stress and help you focus on what matters?whether it?s your career, studies, or family. Start by assessing your needs, comparing lenders, and ensuring you understand the terms. Whether you opt for a bank?s lower rates or a moneylender?s speed, make sure to borrow responsibly and choose a licensed provider. Ready to take the next step? Check out the websites of the lenders listed above and apply for the best foreigner loan in Singapore that suits your needs.

Disclaimer: All information provided here has been compiled from publicly available sources. While we have made every effort to ensure accuracy, we do not guarantee that the information is complete or error-free. We disclaim any liability for inaccuracies or omissions. If you find any errors or have concerns about the content, please let us know so we can address them promptly.

Kaizenaire is the key to empowering Singapore Entrepreneurs in sourcing top-notch remote talents from the Philippines. Beyond mere recruitment, Kaizenaire extends its support with comprehensive onboarding and training solutions to catalyze your business growth. We believe so strongly in our capabilities that we proudly present a risk-free trial offer.

Scalling your business isn't a mystical feat; it's a well-defined cause-and effect process

Offshore To The Philippines To Build Your Team

Better Loyalty ? Lower Cost ? Long Term Success

Welcome to Kaizenaire, where we believe every business has a story worth telling and a product and services worth showcasing.

Kaizenaire Story

- About

- The Ultimate Offshoring Solution

- Offshore To The Philippines ? Risk Free Trial

- Recruitment In The Philippines

- Your Ultimate Dream

- Philippines Offshoring Blogs

- Media Kit

- Business Partnership

- Contact

Kaizenaire Insider

- Singapore Entrepreneurs

- Get Featured In Kaizenaire Insider

- Singapore Companies

AI Tools

- Best AI Tools for Administrative Assistants

- Best AI Tools for Marketing Executives

- Best AI Tools for Interior Designers

- Best AI Tools for Social Media Marketing Specialists

- Best AI Tools for Customer Service Representatives

- Best AI Tools for UI/UX Designers

- Best AI Tools for Web Designers

- Best AI Tools for Drafters

- Best AI Tools for Content Writers

Promotions

- 1 for 1 Halal Buffet Promotions

- 1 For 1 Lunch Promotions

- 1 for 1 High Tea Promotions

- 1 For 1 Dining Promotions

- 1 for 1 Buffet Lunch Promotions

- Hotel Buffet Promotions

- Buffet Promotions

- KFC Promotions

- Haidilao Promotions

Copyright © 2026 Singapore's Lifestyle & Online Shopping & Promotions.

Kaizenaire.com features the best in Singapore: Restaurants, New Restaurants, Cafe Food, Seafood, Asian Restaurants, Italian Restaurants, Indian Restaurants, Japanese Restaurants, Thai Restaurants, Vegan Restaurants, Halal Restaurants, Vegetarian Restaurants, Wine, Date Night Restaurants, Fine Dining, Birthday Restaurants, Ambience Restaurant, Rooftop Bars, Restaurants With A View, Healthy Food, Food Delivery, Food In Bugis, Food In Orchard, Food In Jurong, Food In Vivocity, Tandoori Chicken, Bibimbap, Black Pepper Crab, Chilli Crab, Lava Cake, Cakes, Chocolate, Dessert, Chocolate Lava Cake, Tiramisu, Bingsu, Coffee, Bubble Tea, Beer, Wine, Whiskey, Gin, Makeup Online Shopping, Fashion Brands, Online Clothing Stores, Home Appliances, Luggage, Watches, Bluetooth Earbuds, Kitchen Equipment, Gaming Desktops, Iron For Clothes, TV, Iphone, Phone Brands, Computer Monitors, Mobile Shop, Buy Electronics, Shoes, Shoe Brands, Bag Brands, Sunglasses Brands, Clothing Stores, Jewelry Brands, Shampoo, Perfume, Cardiologists, Dentist, Teeth Whitening, Body Massage, Facial Treatment, Hair Loss Treatment, Hummus, Vegan Food, Gluten Free Bread Brand, Healthy Food, Quality Oil, Honey, Anti Aging Serum, Hyaluronic Acid Serum, Skincare Brands, Hair Treatment, Makeup Products, Hair Stylist, Gym, Pilates, Yoga Clothes, Body Massage, Healthy Food Delivery, Meditation, Yoga Classes, Counseling Services, Chiropractors, Traditional Chinese Medicine, Aromatherapy, Walking Routes, Hikes, Live Music, Events Planners, Clubs, Things To Do In Singapore, Travel Credit Card, Souvenirs, Restaurants In Marina Bay Sands, Game Shop, Games Nintendo Switch Store, Gym, KTV, Coffee Places, Online Board Game Store, Indoor Plants, Lighting Shop, Curtains and Window Blinds, Painting Services, Interior Paint, Furniture, Sofa, Bed Sheets, Mattress, Mattress Brands, Bed, Air Conditioner, Vacuum Cleaner, Fridge Brand, Washing Machine Brand, Dryer, Oven, Plant Nursery, Digital Lock, Smart Tv, Smart Watch, Home Monitoring Camera, Cleaning Services, Laundry Service, Pest Control, Handyman, Personal Loans, Foreigner Loans, Payday Loans, Bad Credit Loans, Emergency Loans, Debt Consolidation Loans, Money Lenders, Loan Products & Services, Legality and Regulations, Borrower Information, Loan Scams, Business Loans, Small Business Loans, Business Start-up Loans, SME Business Loans, Home Loans, Mortgage Loans, Refinancing Loans, Bridging Loans, Housing and HDB Loans, CPF Housing Grants, Education Loans, Wedding Loans, Home Renovation Loans, Car Loans, Grab/Taxi Loans, Savings Accounts, Current Accounts, Fixed Deposit Accounts, Retirement Plannings.