Tab Mapper

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ https://en.poupartsyndic.ca/debt-consolidation-for-bad-credit/.

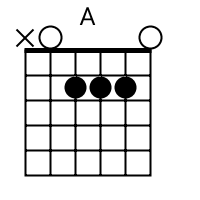

Show me scales that sound good with the chords in this song: A.

Skip to content- Home

- About

-

Solutions

- Debt Consolidation

- Consumer Proposal

- Financial Restructuring

- Voluntary Deposit

- Personal Bankruptcy

- Debt Consolidation

-

Tools

- Calculate my debt ratio

- Online Diagnosis

- Online Budget

- Loan Calculator

- Credit Card Cost

- Calculate my debt ratio

- Blog

- F.A.Q.

- APPOINTMENT

- English

- French

- Home

- About

- SolutionsMenu Toggle

- Debt Consolidation

- Consumer Proposal

- Financial Restructuring

- Voluntary Deposit

- Personal Bankruptcy

- ToolsMenu Toggle

- Calculate my debt ratio

- Online Diagnosis

- Online Budget

- Loan Calculator

- Credit Card Cost

- Blog

- F.A.Q.

- APPOINTMENT

- EnglishMenu Toggle

- Français

Home » Debt consolidation for bad credit: How to do it?

Debt consolidation for bad credit: How to do it?

If you have bad credit and are struggling with a debt problem, debt consolidation for bad credit may be a viable solution for you. It can simplify your monthly payments by bundling all of your debts into a single payment. By doing so, you can also potentially lower your interest rate and reduce the total amount of interest you pay over time.

However, getting a debt consolidation loan with bad credit can be challenging. Here are some steps you can take to consolidate your debts even with bad credit.

1. Evaluate your debts and credit score

The first step to debt consolidation for bad credit is to understand your current financial situation. Take a close look at each debt, including your interest rates and minimum monthly payments. Understanding your financial situation will help you determine if a consolidation loan is a viable solution.

Also, check your credit score, as it will affect your ability to qualify for a debt consolidation loan. Credit scores in Canada range from 300 to 850, and a score of 600 or lower is generally considered bad.

2. Explore your options for debt consolidation for bad credit

There are several bad credit debt consolidation options available, including a bad credit loan, home equity loans and balance transfer credit cards.

Each option has its own advantages and disadvantages, so it is essential to understand the pros and cons of each option. If necessary, you can consult with an expert in the Canadian area to decide which is the best option considering your debt problem.

3. Consider working with counseling for debt consolidation for bad credit.

If you are having difficulty managing debt or if you want to have effective debt consolidation for bad credit, working with credit counseling can be an excellent option.

A counselor can help you develop a plan, with debt and interest rate consolidation as well as negotiate with your creditors. They can also provide valuable financial education and advice on how to improve your credit score.

If you live in the Montreal area, we recommend that you contact Poupart Syndic?s certified professionals.

4. Apply for a loan for debt consolidation for bad credit.

Once you have explored your debt consolidation and interest rate options and identified the best option for you, it?s time to apply for a loan. Applying for a loan with bad credit can be challenging, but it?s not impossible.

First, check with your current bank to see if they offer debt consolidation loans. They may be more willing to work with you if you already have a relationship with them. If not, consider online lenders that specialize in offering loans to people with bad credit.

5. Improve your credit score

Whether or not you are approved for a loan, it is a good idea to work on improving your credit score.

Improving your credit score takes time, but there are a few steps you can take to get started. Paying your bills on time, keeping your credit card balances low and disputing errors on your credit report are effective ways you can try even if you are in a debt consolidation process for bad credit.

6. Consider Other Debt Relief Options

If you are not eligible for a debt consolidation loan, there are other debt relief options to consider.

First is debt settlement, which involves negotiating with your creditors to settle your debts for less than you owe. This option is usually reserved for people who are very far behind in payment and usually with the help of a trustee.

Second, you can file for bankruptcy. Bankruptcy is a legal process that allows individuals to discharge their debts and get a fresh start. Although bankruptcy can provide relief from overwhelming debts, it is often considered a last resort.

Finally, we hope this article will allow you to make an informed financial decision, especially if you are dealing with a debt problem. On the other hand, if you wish to learn more about personal finance you can visit our blog or contact us directly at Poupart Syndic.

- Home

- About

- Blog

- F. A. Q

- Home

- About

- Blog

- F. A. Q

- Debt Consolidation

- Consumer Proposal

- Financial Restructuring

- Voluntary Deposit

- Personal Bankruptcy

- Debt Consolidation

- Consumer Proposal

- Financial Restructuring

- Voluntary Deposit

- Personal Bankruptcy