Tab Mapper

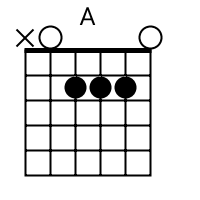

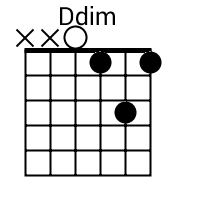

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ http://thesushis-ap.com.

Show me scales that sound good with the chords in this song: A, Do.

Sushi Swap: A Comprehensive Guide to the Popular DEX Exchange

Description: Dex exchange. This article provides a detailed overview of SushiSwap, a leading decentralized exchange (DEX) within the DeFi landscape. We explore its functionalities, advantages, staking mechanisms, and its position relative to other prominent DEX platforms.

Introduction to SushiSwap

In the ever-evolving world of decentralized finance (DeFi), decentralized exchanges (DEXs) have emerged as a cornerstone of innovation, offering users a permissionless and transparent way to trade cryptocurrencies. Among these DEXs, SushiSwap has carved a significant niche, offering not only a platform for token swapping but also a suite of features that contribute to a vibrant and engaging ecosystem. This article delves into the intricacies of SushiSwap, examining its core functionalities, staking mechanisms, and its overall impact on the DeFi landscape. Understanding Sushi Swap is crucial for anyone navigating the world of decentralized finance. It's more than just a sushi swap exchange; it's a community-driven platform that's constantly evolving.

What is SushiSwap?

SushiSwap is a decentralized exchange (DEX) operating on the Ethereum blockchain (and increasingly on other blockchains as well). It functions as an Automated Market Maker (AMM), meaning it relies on smart contracts and liquidity pools rather than traditional order books to facilitate trading. This eliminates the need for intermediaries and allows users to trade directly with each other in a trustless environment. Unlike centralized exchanges, SushiSwap is governed by its community, holders of the SUSHI token, who participate in shaping the platform's future direction. The Sushi Swap exchange aims to be user-friendly and accessible to both experienced and novice DeFi users.

Key Features of SushiSwap

- Token Swapping: At its core, SushiSwap allows users to seamlessly swap between different ERC-20 tokens (and tokens on other supported chains).

- Liquidity Pools: Users can contribute their tokens to liquidity pools and earn a portion of the trading fees generated by those pools.

- Yield Farming: SushiSwap offers various yield farming opportunities, allowing users to earn SUSHI tokens by staking specific liquidity pool tokens (SLP).

- Staking: Users can stake their SUSHI tokens to earn xSUSHI, which entitles them to a portion of the platform's trading fees.

- SushiBar (xSUSHI): Staking SUSHI for xSUSHI gives users a share of the trading fees generated by the platform. This provides a continuous incentive to hold and support the SushiSwap ecosystem.

- Onsen Program: The Onsen program incentivizes liquidity for newer or less established tokens by offering increased SUSHI rewards for specific liquidity pools.

- SushiSwap MISO (Minimal Initial Sushi Offering): A launchpad for new projects to launch their tokens and raise capital.

- Kashi Lending: An isolated lending market that allows users to create customized lending and borrowing markets with isolated risk.

- Trident AMM: A more capital-efficient AMM with various pool types.

How SushiSwap Works: Automated Market Makers (AMMs)

SushiSwap, like many DEXs, utilizes the Automated Market Maker (AMM) model. Let's break down how it works:

- Liquidity Pools: Instead of relying on order books, SushiSwap uses liquidity pools. These pools hold reserves of two different tokens, creating a market for those tokens. For instance, a ETH/USDT pool holds both ETH and USDT.

- Liquidity Providers (LPs): Users can deposit tokens into these pools, becoming Liquidity Providers (LPs). In return, they receive LP tokens (SLP in SushiSwap's case) representing their share of the pool.

- Trading Mechanism: When a trader wants to swap ETH for USDT, they interact with the ETH/USDT pool. The AMM algorithm determines the exchange rate based on the ratio of tokens within the pool. As the trader swaps ETH for USDT, the amount of ETH in the pool decreases, and the amount of USDT increases, causing the price of ETH to rise slightly (and the price of USDT to fall slightly). This mechanism ensures that trades can always be executed, even with limited trading volume.

- Fees for Liquidity Providers: LPs earn a percentage of the trading fees generated by their respective pools. This incentivizes them to provide liquidity and support the SushiSwap ecosystem. The fees are typically distributed proportionally based on their share of the pool.

Understanding Impermanent Loss

Providing liquidity is not without risk. One of the primary risks is Impermanent Loss. Impermanent Loss occurs when the price ratio of the two tokens in a liquidity pool diverges. For example, if you deposit ETH and USDT into a pool, and the price of ETH doubles relative to USDT, you may experience impermanent loss. This is because the AMM algorithm will rebalance the pool by selling some of your ETH and buying USDT to maintain the price ratio. While you still earn trading fees, the gains may not fully offset the potential loss from the price divergence. The higher the price divergence, the greater the impermanent loss. It's crucial to understand this risk before providing liquidity to any AMM, including SushiSwap.

SUSHI Token: Governance and Staking

The SUSHI token is the native governance token of the SushiSwap platform. It plays a vital role in the ecosystem, empowering token holders to participate in decision-making and earn rewards.

Governance

SUSHI holders have the power to vote on proposals that affect the future of the SushiSwap protocol. This includes decisions regarding new features, protocol upgrades, fee structures, and the overall direction of the platform. The decentralized governance model ensures that the community has a voice in shaping the evolution of SushiSwap.

Staking SUSHI for xSUSHI

Users can stake their SUSHI tokens in the SushiBar to receive xSUSHI tokens. xSUSHI represents a claim on a portion of the trading fees generated by the SushiSwap exchange. The fees are collected and used to buy back SUSHI tokens from the market, which are then distributed to xSUSHI holders. This creates a continuous buy pressure on the SUSHI token and provides a passive income stream for stakers. Staking SUSHI is a way to earn income and participate in the success of the sushi swap exchange.

Benefits of Staking

- Passive Income: Earn a share of the platform's trading fees.

- Governance Rights: Participate in the decision-making process.

- Support the Ecosystem: Staking contributes to the overall health and stability of the SushiSwap platform.

SushiSwap Onsen Program

The SushiSwap Onsen program is designed to incentivize liquidity provision for newer and less established tokens. By offering increased SUSHI rewards for specific liquidity pools, Onsen helps these projects gain traction and build liquidity. This is a great way to discover promising new projects on the sushi swap exchange.

How Onsen Works

- SushiSwap identifies promising new projects and selects specific liquidity pools for inclusion in the Onsen program.

- LPs who provide liquidity to these pools receive boosted SUSHI rewards in addition to the standard trading fees.

- The increased rewards attract more liquidity, making it easier for users to trade these tokens.

- The Onsen program helps new projects gain visibility and build a strong foundation for future growth.

Risks Associated with Onsen

While Onsen can be lucrative, it's essential to be aware of the associated risks:

- Volatility: Newer tokens are often more volatile than established tokens, meaning the price can fluctuate significantly.

- Rug Pulls: There's always a risk that the project team could abandon the project and run away with the funds (a "rug pull").

- Impermanent Loss: As with all liquidity pools, impermanent loss is a potential risk.

Therefore, it's crucial to do thorough research before participating in the Onsen program and only invest what you can afford to lose. Always DYOR (Do Your Own Research) before investing in any cryptocurrency or DeFi project, especially those with high rewards.

SushiSwap MISO (Minimal Initial Sushi Offering)

SushiSwap MISO (Minimal Initial Sushi Offering) is a launchpad that allows new projects to launch their tokens and raise capital in a decentralized and permissionless manner. It provides a suite of tools and services to help projects streamline the token launch process.

Benefits of MISO

- Decentralized Launch: Projects can launch their tokens directly to the community without relying on centralized exchanges.

- Customizable Launch Options: MISO offers a variety of launch options, including Dutch auctions, fixed-price sales, and batch auctions.

- Streamlined Process: MISO provides tools for token creation, vesting schedules, and other essential aspects of a token launch.

- Community Engagement: MISO encourages community participation and allows projects to build a strong user base from the outset.

SushiSwap Kashi Lending

SushiSwap Kashi Lending is an isolated lending market that allows users to create customized lending and borrowing markets with isolated risk. Unlike traditional lending platforms where risk is pooled across all assets, Kashi isolates the risk to each individual market. This means that if one market experiences a default, it doesn't affect the other markets.

Key Features of Kashi

- Isolated Risk: Each lending market is isolated, protecting lenders and borrowers from systemic risk.

- Customizable Markets: Users can create lending markets for virtually any ERC-20 token.

- Flexible Collateral Ratios: Users can adjust the collateralization ratio to suit their risk tolerance.

- Lower Fees: Kashi often offers lower fees compared to traditional lending platforms.

How Kashi Works

- A user creates a new lending market for a specific token pair (e.g., ETH/DAI).

- Lenders deposit ETH into the market to earn interest.

- Borrowers deposit DAI as collateral and borrow ETH.

- The interest rates are determined by supply and demand.

- If a borrower's collateral falls below the required ratio, their position is liquidated.

SushiSwap Trident AMM

SushiSwap Trident is a more capital-efficient Automated Market Maker (AMM) that introduces various pool types designed to optimize trading and liquidity provision. It aims to address some of the limitations of traditional AMMs like constant product pools.

Key Features of Trident

- Hybrid Pools: Trident supports hybrid pools that combine different types of AMM curves.

- Concentrated Liquidity: Allows liquidity providers to concentrate their liquidity within a specific price range, improving capital efficiency.

- Composable Architecture: Built with a modular and composable architecture, making it easy to integrate with other DeFi protocols.

- Optimized Gas Efficiency: Designed to minimize gas costs, making trading and liquidity provision more affordable.

Types of Pools in Trident

- Constant Product Pools (x*y=k): Similar to traditional AMMs, but optimized for gas efficiency.

- Stable Pools: Designed for stablecoins or assets with a tight peg, minimizing slippage.

- Concentrated Liquidity Pools: Allows LPs to specify a price range where they want to provide liquidity, improving capital efficiency.

Benefits of Trident

- Increased Capital Efficiency: Allows LPs to earn higher returns with the same amount of capital.

- Reduced Slippage: Minimizes the impact of large trades on the price of the assets.

- Lower Gas Costs: Makes trading and liquidity provision more affordable.

SushiSwap vs. Other DEXs

SushiSwap is not the only DEX in the DeFi space. Let's compare it to some of its competitors:

- Uniswap: One of the first and most popular DEXs. SushiSwap initially forked from Uniswap but has since evolved with its own unique features. Uniswap is generally considered to have a simpler interface, while SushiSwap offers a wider range of functionalities, including yield farming and staking.

- PancakeSwap: A popular DEX on the Binance Smart Chain (BSC). PancakeSwap offers lower transaction fees than SushiSwap (which primarily operates on Ethereum) but is also more centralized.

- Curve Finance: A DEX specifically designed for trading stablecoins. Curve focuses on minimizing slippage for stablecoin swaps, while SushiSwap offers a broader range of trading options.

The best DEX for you will depend on your specific needs and preferences. Consider factors such as transaction fees, available features, and the assets you want to trade.

Security Considerations When Using SushiSwap

While SushiSwap offers many advantages, it's crucial to be aware of the security risks associated with using any decentralized exchange:

- Smart Contract Risks: SushiSwap relies on smart contracts, which are susceptible to bugs and vulnerabilities. Always exercise caution and be aware of the potential risks associated with smart contracts.

- Impermanent Loss: As mentioned earlier, impermanent loss is a significant risk for liquidity providers.

- Rug Pulls: Be wary of new and unproven projects, as there's always a risk of a rug pull.

- Phishing Scams: Be cautious of phishing scams that attempt to steal your private keys or seed phrases. Always verify the website address and never share your sensitive information with anyone.

Best Practices for Security

- Use a Hardware Wallet: Store your cryptocurrencies on a hardware wallet for added security.

- Enable 2FA: Enable two-factor authentication (2FA) on your accounts.

- Verify Website Addresses: Always double-check the website address before interacting with any DeFi platform.

- Stay Informed: Stay up-to-date on the latest security threats and best practices.

SushiSwap and the Future of DeFi

SushiSwap has played a significant role in the growth and evolution of the DeFi ecosystem. Its innovative features and community-driven governance model have helped to shape the landscape of decentralized finance. As DeFi continues to mature, SushiSwap is likely to remain a prominent player, adapting to the changing needs of the market and pushing the boundaries of what's possible.

The future of DeFi is bright, and SushiSwap is well-positioned to contribute to its ongoing success. With its commitment to innovation and community engagement, SushiSwap is likely to remain a leader in the decentralized finance space for years to come.

Summary Table: Key Information About SushiSwap

| Feature | Description | Benefits | Risks |

|---|---|---|---|

| Token Swapping | Exchange tokens directly on the platform. | Fast, convenient, and decentralized. | Slippage can occur, especially with low liquidity. |

| Liquidity Pools | Provide liquidity to pools and earn fees. | Passive income and contribute to the ecosystem. | Impermanent loss. |

| SUSHI Staking (xSUSHI) | Stake SUSHI to earn a portion of trading fees. | Passive income and governance rights. | Lock-up period and potential price volatility of SUSHI. |

| Onsen Program | Earn boosted SUSHI rewards for providing liquidity to select pools. | High rewards and exposure to new projects. | Higher risk of volatility and rug pulls. |

| Kashi Lending | Isolated lending and borrowing markets. | Isolated risk, customizable markets. | Smart contract risk, liquidation risk. |

| Trident AMM | Capital-efficient AMM with various pool types. | Increased capital efficiency, reduced slippage. | Complex to understand and manage. |

| MISO | Token launch platform. | Decentralized launch, customizable options. | Potential for scams, project failure. |

Conclusion

SushiSwap stands as a prominent and versatile decentralized exchange (DEX) within the DeFi ecosystem. Its features, ranging from token swapping and liquidity provision to innovative programs like Onsen and MISO, offer a diverse range of opportunities for users. However, it's crucial to understand the associated risks, such as impermanent loss and smart contract vulnerabilities. By carefully considering these factors and following best practices for security, users can navigate the SushiSwap platform with confidence and participate in the exciting world of decentralized finance. The sushi swap exchange is a vital part of the DeFi landscape, offering a range of features that benefit both traders and liquidity providers. Ultimately, the success of SushiSwap, and the entire DeFi ecosystem, hinges on informed participation and a commitment to security and innovation. The sushi swap exchange continues to evolve, offering new opportunities and challenges for users and developers alike.

sushiswap,sushi swap,sushi swap exchange,sushiswap exchange

Contact: [email protected]