Tab Mapper

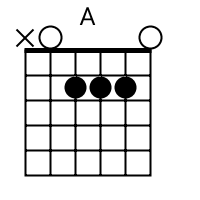

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ http://thesushi-sawp.com.

Show me scales that sound good with the chords in this song: A.

Sushiswap: A Deep Dive into the DeFi Exchange

DeFi Explained

Introduction to Sushiswap

Sushiswap is a decentralized exchange (DEX) built on the Ethereum blockchain, primarily functioning as an Automated Market Maker (AMM). It emerged as a fork of Uniswap but quickly distinguished itself by introducing unique features and a community-driven governance model. Sushiswap allows users to trade cryptocurrencies without intermediaries, relying on smart contracts to execute trades and provide liquidity. This article provides an in-depth look at Sushiswap, its functionalities, tokenomics, and its overall impact on the decentralized finance (DeFi) landscape.

What is a Decentralized Exchange (DEX)?

Before diving into the specifics of Sushiswap, it's essential to understand the concept of a Decentralized Exchange (DEX). Unlike traditional cryptocurrency exchanges like Coinbase or Binance, DEXs are non-custodial platforms. This means users maintain control of their private keys and funds at all times. Trades are executed directly between users' wallets through smart contracts, eliminating the need for a central authority. This inherently increases security and transparency, reducing the risk of hacks and censorship.

Automated Market Makers (AMMs): The Engine of Sushiswap

Sushiswap operates as an Automated Market Maker (AMM). AMMs replace the traditional order book system used in centralized exchanges with liquidity pools. These pools are populated by users who deposit tokens in exchange for liquidity provider (LP) tokens. When a trade occurs, the smart contract algorithmically determines the price based on the ratio of tokens in the pool. This removes the reliance on market makers and allows for continuous trading, 24/7.

How AMMs Work in Practice

Let's say you want to trade Ether (ETH) for Tether (USDT) on Sushiswap. Instead of matching buy and sell orders, Sushiswap uses a liquidity pool containing both ETH and USDT. The price of ETH is determined by the ratio of ETH to USDT in the pool. If someone buys a lot of ETH, the amount of ETH in the pool decreases, and the amount of USDT increases, causing the price of ETH to rise. Conversely, if someone sells a lot of ETH, the price decreases.

The Constant Product Formula: x * y = k

Most AMMs, including Sushiswap, use the Constant Product Formula: x * y = k. Here, 'x' represents the amount of one token in the pool, 'y' represents the amount of the other token, and 'k' is a constant. This formula ensures that liquidity is always available, albeit with varying levels of slippage (the difference between the expected price and the actual price received).

Sushiswap's Key Features and Functionalities

Sushiswap offers a variety of features that contribute to its popularity and functionality within the DeFi space.

Token Swapping

The core function of Sushiswap is the ability to swap one cryptocurrency for another. Users can easily exchange tokens through the platform's intuitive interface, with fees typically ranging from 0.25% to 0.3% per trade. These fees are distributed to liquidity providers, incentivizing them to deposit their tokens into the pools.

Liquidity Providing

Users can contribute liquidity to Sushiswap pools by depositing equal values of two tokens. In return, they receive LP tokens, which represent their share of the pool. These LP tokens can then be staked to earn SUSHI tokens (Sushiswap's native token) as a reward.

Yield Farming

Sushiswap popularized the concept of yield farming, which involves staking LP tokens to earn additional rewards, typically in the form of SUSHI tokens. This incentivizes users to provide liquidity and participate in the Sushiswap ecosystem. Various "farms" are available, each offering different reward rates and token pairs.

Staking SUSHI

Users can stake their SUSHI tokens to earn xSUSHI, which entitles them to a portion of the trading fees generated by the platform. This creates a virtuous cycle, where increased trading activity leads to higher rewards for SUSHI stakers, further incentivizing participation and holding of the SUSHI token.

SushiBar

The SushiBar is where users stake their SUSHI tokens to receive xSUSHI. xSUSHI holders receive a portion of the trading fees generated by the Sushiswap platform, further incentivizing long-term holding and platform participation. The SushiBar is a crucial component of the SUSHI token's utility.

BentoBox

BentoBox is a lending and margin trading platform built on top of Sushiswap. It allows users to borrow and lend tokens, as well as engage in margin trading, leveraging their positions for potentially higher returns (and risks). BentoBox aims to provide a more capital-efficient DeFi experience.

Kashi

Kashi is a lending platform within the BentoBox ecosystem that allows for isolated lending pairs. This means that each lending pair operates independently, mitigating the risk of cascading liquidations and systemic failures. This innovative approach offers greater flexibility and risk management for lenders and borrowers.

MISO

MISO (Minimal Initial Sushi Offering) is a platform for launching new tokens on Sushiswap. It provides a suite of tools and services to help projects launch their tokens in a secure and decentralized manner. MISO aims to streamline the token launch process and increase accessibility for new DeFi projects.

Onsen

Onsen provides incentives for new and emerging projects within the Sushiswap ecosystem. It offers temporary liquidity mining programs to bootstrap liquidity for these projects, helping them gain traction and attract users. Onsen plays a crucial role in fostering innovation and growth within the Sushiswap ecosystem.

Trident

Trident is a next-generation AMM protocol developed by the Sushiswap team. It aims to improve upon existing AMM designs by offering features such as concentrated liquidity, lower gas fees, and more efficient capital utilization. Trident represents Sushiswap's ongoing commitment to innovation and improvement.

The SUSHI Token: Governance and Utility

SUSHI is the native governance token of the Sushiswap platform. It plays a vital role in the ecosystem, providing holders with voting rights and access to platform rewards.

Governance

SUSHI holders can participate in the governance of the Sushiswap protocol by voting on proposals that affect the platform's development, fee structure, and other important decisions. This decentralized governance model ensures that the platform is driven by the community.

Staking Rewards

As mentioned earlier, users can stake their SUSHI tokens to earn xSUSHI, which entitles them to a portion of the trading fees generated by the platform. This incentivizes long-term holding of the SUSHI token and aligns the interests of token holders with the success of the platform.

Tokenomics

The initial supply of SUSHI tokens was created through a controversial "vampire mining" event, where liquidity was migrated from Uniswap to Sushiswap. The total supply of SUSHI is uncapped, with new tokens being minted as rewards for liquidity providers and stakers. The distribution of SUSHI tokens is carefully managed to ensure the long-term sustainability of the platform.

Sushiswap vs. Uniswap: A Comparison

Sushiswap emerged as a direct competitor to Uniswap, offering similar functionalities but with some key differences.

Community Governance

One of the main differences between Sushiswap and Uniswap is their governance models. Sushiswap is governed by its community of SUSHI holders, while Uniswap is primarily managed by its development team. This decentralized governance model allows Sushiswap to be more responsive to the needs of its users.

Token Rewards

Sushiswap offers SUSHI token rewards to liquidity providers, while Uniswap initially did not have a token. The introduction of the UNI token by Uniswap later addressed this difference, but Sushiswap's early mover advantage in rewarding liquidity providers helped it gain significant traction.

Fee Structure

Both Sushiswap and Uniswap charge a 0.3% trading fee, with the majority of the fees going to liquidity providers. However, Sushiswap distributes a portion of the fees to xSUSHI stakers, providing an additional incentive for holding the SUSHI token.

Innovation

Sushiswap has consistently introduced new features and functionalities, such as BentoBox, Kashi, and MISO, which have helped it differentiate itself from Uniswap. Uniswap, while maintaining a strong core product, has focused more on optimizing its core AMM functionality.

The Future of Sushiswap

Sushiswap continues to evolve and innovate within the DeFi landscape. The platform is actively developing new features and exploring new use cases for its technology. With its strong community governance and commitment to innovation, Sushiswap is poised to remain a major player in the decentralized finance ecosystem.

Cross-Chain Expansion

Sushiswap is actively exploring cross-chain compatibility, aiming to expand its reach to other blockchains. This would allow users to trade tokens across different chains, increasing liquidity and accessibility. Cross-chain functionality is a crucial step towards a more interconnected DeFi ecosystem.

Layer-2 Scaling Solutions

To address the high gas fees on the Ethereum network, Sushiswap is exploring Layer-2 scaling solutions such as Optimism and Arbitrum. These solutions can significantly reduce transaction costs and increase transaction speeds, making Sushiswap more accessible to a wider range of users.

Institutional Adoption

As DeFi becomes more mainstream, Sushiswap is positioning itself to attract institutional investors. This may involve developing features tailored to the needs of institutions, such as enhanced security and compliance measures.

Risks and Challenges Associated with Sushiswap

While Sushiswap offers numerous benefits, it's important to be aware of the potential risks and challenges involved.

Smart Contract Risks

Like all DeFi protocols, Sushiswap is susceptible to smart contract vulnerabilities. A bug in the code could lead to the loss of funds. While Sushiswap undergoes regular audits, the risk of a smart contract exploit cannot be completely eliminated.

Impermanent Loss

Liquidity providers on Sushiswap are exposed to impermanent loss, which occurs when the price of the tokens in a liquidity pool diverges. This can result in a lower return than simply holding the tokens. Understanding impermanent loss is crucial for anyone considering providing liquidity on Sushiswap.

Regulatory Uncertainty

The regulatory landscape surrounding DeFi is still evolving. New regulations could potentially impact the legality and operation of Sushiswap. It's important to stay informed about the latest regulatory developments in the DeFi space.

Volatility

The cryptocurrency market is highly volatile, and the value of SUSHI and other tokens can fluctuate significantly. This volatility can impact the profitability of yield farming and staking activities.

Table: Sushiswap Key Metrics and Information

| Metric/Information | Description |

|---|---|

| Name | Sushiswap |

| Type | Decentralized Exchange (DEX) |

| Blockchain | Ethereum |

| Native Token | SUSHI |

| AMM Model | Constant Product (x * y = k) |

| Trading Fee | 0.3% (distributed to LPs and xSUSHI stakers) |

| Governance | Community-governed via SUSHI token holders |

| Key Features | Token Swapping, Liquidity Providing, Yield Farming, Staking (SushiBar), BentoBox, Kashi, MISO, Onsen, Trident |

Conclusion

Sushiswap has established itself as a prominent player in the DeFi space, offering a range of functionalities and a strong community-driven governance model. While it faces competition and inherent risks associated with decentralized finance, its continuous innovation and commitment to community make it a platform to watch. Understanding the core concepts of DEXs, AMMs, and the specifics of Sushiswap?s ecosystem is crucial for anyone looking to participate in the future of decentralized finance. By staying informed about the latest developments and understanding the associated risks, users can make informed decisions and potentially benefit from the opportunities offered by Sushiswap and the broader DeFi ecosystem.

sushi swap,sushiswap,sushi swap exchange,sushiswap exchange

Contact: [email protected]