Tab Mapper

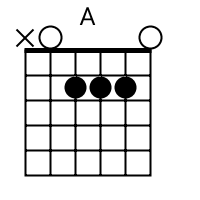

The tab mapper is a handy little tool that will render a guitar tab file with graphic chord diagrams displayed alongside. This comes in handy for people who just don't have every single chord shape memorized. Just plug in the web site address of a valid .tab or .crd file and hit "Go". In general, the tab mapper does a better job with printer friendly URLs. If there is more than one way to play a chord, the tab mapper will choose the most common shape. To see other fingerings, click on the chord diagram and you will be taken to the chord calculator.

Original file located @ http://charteredaccountants.ie.

Show me scales that sound good with the chords in this song: A.

- Current students

-

- Student centre

Enrol on a course/examMy enrolmentsExam resultsMock exams

- Course information

Students FAQsStudent inductionCourse enrolment informationKey datesBook distributionTimetablesFAE elective informationCPA Ireland student

- Exams

CAP1 examCAP2 examFAE examAccess support/reasonable accommodationE-Assessment informationExam and appeals regulations/exam rulesTimetables for exams & interim assessmentsSample papersPractice papersExtenuating circumstancesPEC/FAEC reportsInformation and appeals schemeCertified statements of resultsJIEB: NI Insolvency Qualification

- CA Diary resources

Mentors: Getting started on the CA DiaryCA Diary for Flexible Route FAQs

- Admission to membership

Joining as a reciprocal memberAdmission to Membership CeremoniesAdmissions FAQs

- Support & services

Recruitment to and transferring of training contractsCASSIStudent supports and wellbeingAudit qualificationDiversity and Inclusion Committee

- Student centre

-

Students

View all the services available for students of the Institute

Read More

-

- Becoming a student

-

- About Chartered Accountancy

The Chartered differenceStudent benefitsStudy in Northern IrelandEventsHear from past studentsBecome a Chartered Accountant podcast series

- Entry routes

CollegeWorkingAccounting TechniciansSchool leaversMember of another bodyCPA studentInternational studentFlexible RouteTraining Contract

- Course description

CAP1CAP2FAEOur education offering

- Apply

How to applyExemptions guideFees & payment optionsExternal students

- Training vacancies

Training vacancies searchTraining firms listLarge training firmsMilkroundRecruitment to and transferring of training contract

- Support & services

Becoming a student FAQsSchool BootcampRegister for a school visitThird Level HubWho to contact for employers

- About Chartered Accountancy

-

Becoming a

studentStudy with us

Read More

-

- Members

-

- Members Hub

My accountMember subscriptionsNewly admitted membersAnnual returnsApplication formsCPD/eventsMember services A-ZDistrict societiesProfessional StandardsACA ProfessionalsCareers developmentRecruitment serviceDiversity and Inclusion Committee

- Members in practice

Going into practiceManaging your practice FAQsPractice compliance FAQsToolkits and resourcesAudit FAQsPractice Consulting servicesPractice News/Practice MattersPractice Link

- In business

Networking and special interest groupsArticles

- Overseas members

HomeKey supportsTax for returning Irish membersNetworks and people

- Public sector

Public sector presentations

- Member benefits

Member benefits

- Support & services

Letters of good standing formMember FAQsAML confidential disclosure formInstitute Technical contentTaxSource TotalThe Educational Requirements for the Audit QualificationPocket diariesThrive Hub

- Members Hub

-

Members

View member services

Read More

-

- Employers

-

- Training organisations

Authorise to trainTraining in businessManage my studentsIncentive SchemeRecruitment to and transferring of training contractsSecuring and retaining the best talentTips on writing a job specification

- Training

In-house trainingTraining tickets

- Recruitment services

Hire a qualified Chartered AccountantHire a trainee student

- Non executive directors recruitment service

- Support & services

Hire members: log a job vacancyFirm/employers FAQsTraining ticket FAQsAuthorisationsHire a roomWho to contact for employers

- Training organisations

-

Employers

Services to support your business

Read More

-

-

Find a firm

-

Jobs

- Login

-

Home

-

Knowledge centre

-

Professional development

-

About us

-

Shop

-

News

| View Cart 0 Item |

-

Responsible AI webinar

Thursday, 13 February

Read More -

Foreign Direct Investment in Ireland

A guide

Read More -

CA Support with you always

Help us to support you

Read More

Find a Chartered Accountant

Find a Chartered Accountant

Find a Chartered Accountant or firm in your area.

CPA Ireland students

CPA Ireland students

Guidance on the amalgamation for current and prospective students of CPA Ireland.

Career development

Career development

Check out the range of specialist qualifications this autumn

Becoming a student

Becoming a student

Ireland?s leading internationally recognised business qualification. We have flexible education routes designed for people with busy lives.

Latest news

ViDA: Preparing for VAT in the Digital Age

?Rapid delivery by new government is critical? ? Chartered Accountants Ireland President notes ahead of Annual Dinner

Institute welcomes commitments on key policy areas in new Programme for Government

Specialist qualifications

Accountancy Ireland

CHARIOT/Institute Technical Content

Professional Standards

Chartered Accountants House

Becoming a statutory auditor

Thrive - wellbeing hub

Make a complaint

The latest news to your inbox

Useful links

- Current students

- Becoming a student

- Knowledge centre

- Shop

- District societies

Get in touch

Chartered Accountants

House, 47-49 Pearse St,

Dublin 2, D02 YN40, Ireland

The Linenhall

32-38 Linenhall Street, Belfast,

Antrim, BT2 8BG, United Kingdom

Connect with us

Something wrong?

Is the website not looking right/working right for you?Browser support

© Copyright Chartered Accountants Ireland 2020. All Rights Reserved.

-

Terms & conditions

-

Privacy statement

-

Event privacy notice

-

Sitemap

Please wait while the page loads.